HSBC UK now lets credit card customers pay in instalments when using Apple Pay

HSBC UK has introduced a new feature that allows eligible credit card customers to split purchases into monthly instalments when checking out online or in apps with Apple Pay.

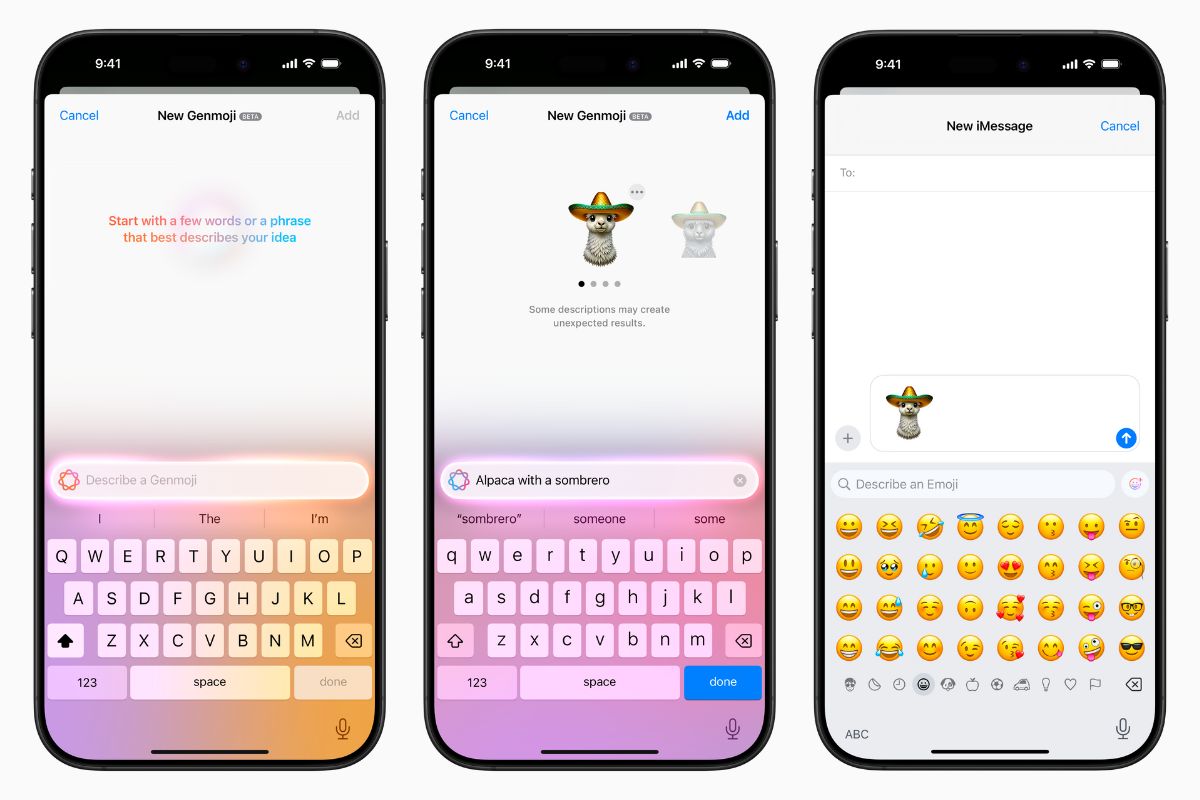

The option appears at checkout when using Apple Pay on iPhone or iPad. Customers can select their HSBC credit card in Wallet, choose Pay Later, and then pick from a range of available repayment plans before confirming the purchase.

To qualify, the transaction must be at least £100 and made online or in-app using Apple Pay.

HSBC says the plans come with fixed monthly fees ranging between 1.5% and 8% of the total plan value. There is no interest charged on the remaining balance, and customers can track repayments through the HSBC UK mobile app and their monthly statements.

Everything is set up directly on the device during checkout, with no additional paperwork or approvals required at the time of purchase for eligible users.

The feature is available now to HSBC UK credit card holders running iOS 18.2 or later on iPhone or iPad.

As with all Apple Pay transactions, Apple does not store transaction information that can be linked back to the user.

Colin O’Flaherty, Head of Unsecured Lending at HSBC UK, said the feature is designed to give customers more flexibility in how they pay, directly from the devices they already use every day.

For Apple users, this effectively adds a built-in “buy now, pay later” option at checkout, without needing to use a third-party finance provider or leave the Apple Pay flow.