Apple Card will soon let users automatically deposit Daily Cash into a Savings account from Goldman Sachs

Apple has announced that in the coming months, Apple Card users will be able to open the new high-yield Savings account and have their Daily Cash automatically deposited into it — with no fees, no minimum deposits, and no minimum balance requirements.

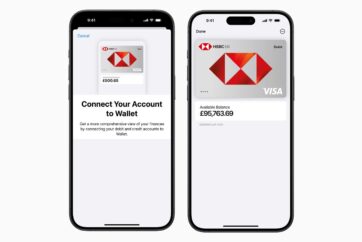

With the new Savings account, Apple Card users will be able to set up and manage Savings directly in their Apple Card in Wallet. Once users set up their Savings account, all future Daily Cash received will be automatically deposited into it, or they can choose to continue to have it added to an Apple Cash card in Wallet.

Additionally, users will also be able to deposit additional funds into their Savings account through a linked bank account, or from their Apple Cash balance. Users can also withdraw funds at any time by transferring them to a linked bank account or to their Apple Cash card, with no fees.

Image: Apple

Daily Cash is Apple’s name for cash-back earned from purchases made using the Apple Card. When users buy something with Apple Card, they get a percentage of their purchase back in Daily Cash. There’s no limit to how much Daily Cash a user can get, and it automatically goes into their Apple Cash account, so it can used just like cash.

Apple Card is only available in the US. Users can make purchases using their Apple Card with Apple Pay on their iPhone, iPad, Apple Watch, and Mac, or with the optional titanium Apple Card bank card, which features no printed card number or security code, making it the world’s most secure credit card.

Follow @TheApplePost on Twitter for the latest coverage and analysis on all things Apple. Read the day’s latest stories and stay on top of the latest Apple news, iPhone leaks and Mac rumors with the theapplepost.com app – available from the App Store.